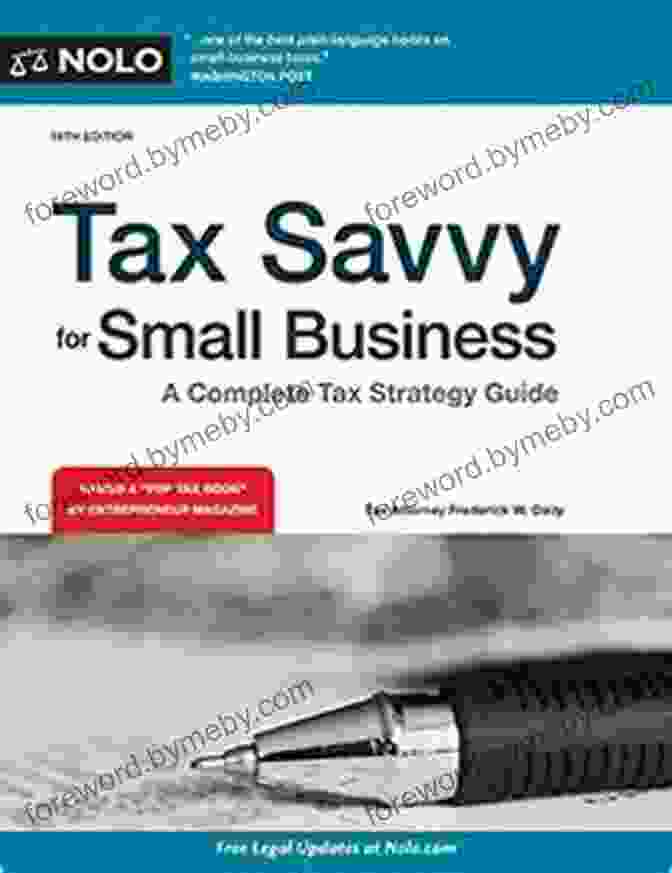

Maximize Your Profits: Essential Tax Strategies for Thriving Small Businesses

Unlock the Secrets of Tax Efficiency with "Tax Savvy for Small Business"

In the competitive landscape of today's business world, it's imperative for small businesses to optimize their operations for maximum efficiency and profitability. One crucial aspect often overlooked is tax planning and management. "Tax Savvy for Small Business" is an indispensable guide that empowers entrepreneurs and small business owners with the knowledge and strategies to navigate the complex tax system and minimize their tax burden.

Comprehensive Coverage of Tax Essentials

"Tax Savvy for Small Business" provides a comprehensive overview of tax laws and regulations, tailored specifically for small businesses. It covers a wide range of topics, including:

4.7 out of 5

| Language | : | English |

| File size | : | 28726 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 377 pages |

- Business Structure and Tax Implications: Explore the different business structures (e.g., LLCs, corporations) and their impact on tax liability.

- Tax Deductions and Credits: Discover a wealth of tax deductions and credits available to small businesses, such as home office expenses, depreciation, and research and development costs.

- Employment and Payroll Taxes: Understand the intricacies of employment taxes, including payroll withholding, Social Security, and Medicare.

- Tax Audits and Appeals: Learn how to prepare for and respond to IRS audits, and strategies for appealing unfavorable tax determinations.

Practical Strategies for Tax Minimization

Beyond the basics, "Tax Savvy for Small Business" delves into advanced tax strategies to help small businesses significantly reduce their tax liability. These strategies include:

- Entity Selection for Tax Optimization: Choose the business structure that aligns with your tax objectives, considering factors such as pass-through taxation and tax-exempt status.

- Retirement Planning: Leverage tax-advantaged retirement plans, such as 401(k)s and IRAs, to minimize current tax liability while securing future financial stability.

- Accounting for Tax Benefits: Keep meticulous records and follow proper accounting procedures to maximize eligible tax deductions and ensure accurate tax reporting.

- Negotiating Tax Settlements: In the event of an IRS audit, explore strategies for negotiating favorable settlements that protect your financial interests.

Case Studies and Real-World Examples

"Tax Savvy for Small Business" goes beyond theoretical explanations by incorporating real-world case studies and examples. These practical insights demonstrate how small businesses have successfully implemented tax-saving strategies to enhance their profitability.

Benefits of Tax Efficiency

By implementing the tax-saving strategies outlined in "Tax Savvy for Small Business," small business owners can reap numerous benefits, including:

- Increased Cash Flow: Minimizing tax liability frees up more cash for business operations, investments, and growth initiatives.

- Improved Profitability: Reduced tax expenses directly translate into higher net profits, strengthening your financial position.

- Reduced Stress and Compliance Risk: Understanding tax laws and regulations alleviates stress and minimizes the risk of non-compliance and penalties.

- Competitive Advantage: Tax efficiency gives small businesses a competitive edge by allowing them to offer lower prices or invest more heavily in their operations than competitors with higher tax burdens.

"Tax Savvy for Small Business" is an invaluable resource for entrepreneurs and small business owners who seek to maximize their profitability and minimize their tax liability. By equipping yourself with the knowledge and strategies outlined in this comprehensive guide, you can navigate the complexities of the tax system and unlock the full potential of your business.

Don't let tax inefficiencies hinder the growth and success of your small business. Free Download your copy of "Tax Savvy for Small Business" today and start reaping the rewards of tax-efficient operations.

4.7 out of 5

| Language | : | English |

| File size | : | 28726 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 377 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Filipe Amorim

Filipe Amorim Euston Quah

Euston Quah Fawzia Gilani Williams

Fawzia Gilani Williams Roy H Williams

Roy H Williams Fabien Clavel

Fabien Clavel Kevin Griffith

Kevin Griffith Erika Rogers Holland

Erika Rogers Holland R L Stine

R L Stine Francesca Valente

Francesca Valente Frank Close

Frank Close Lorelou Desjardins

Lorelou Desjardins Naktsang Nulo

Naktsang Nulo Eugene B Kogan

Eugene B Kogan Fish Davis

Fish Davis Jansen Art Studio

Jansen Art Studio Eunice Perneel Cooke

Eunice Perneel Cooke Fatime Losonci

Fatime Losonci Eugene Bright

Eugene Bright James C Clark

James C Clark Frances Stanfield

Frances Stanfield

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Hayden MitchellUnlocking the Path to Child Development: Unveiling the Essential Role of...

Hayden MitchellUnlocking the Path to Child Development: Unveiling the Essential Role of...

William FaulknerThee Apocryphal Scriptures Ov Genesis Breyer Orridge And Thee Third Mind Ov:...

William FaulknerThee Apocryphal Scriptures Ov Genesis Breyer Orridge And Thee Third Mind Ov:... Gabriel MistralFollow ·14.9k

Gabriel MistralFollow ·14.9k George MartinFollow ·10k

George MartinFollow ·10k Terry BellFollow ·15.5k

Terry BellFollow ·15.5k Jeremy CookFollow ·2.8k

Jeremy CookFollow ·2.8k Doug PriceFollow ·9.1k

Doug PriceFollow ·9.1k Truman CapoteFollow ·14.9k

Truman CapoteFollow ·14.9k Felix HayesFollow ·4.8k

Felix HayesFollow ·4.8k Francis TurnerFollow ·10k

Francis TurnerFollow ·10k

Al Foster

Al FosterDive into the Enchanting World of Manatees: An...

Unveiling the Secrets of the Gentle...

Isaac Mitchell

Isaac MitchellThe Farm Reggie and Friends: US Version - A Captivating...

A Heartwarming Tale that Embraces...

Esteban Cox

Esteban CoxThe Interior Design Handbook: Your Comprehensive Guide to...

Are you ready to...

William Wordsworth

William WordsworthFall Head Over Heels for "Esio Trot" by Roald Dahl: A...

Prepare to be charmed, amused, and utterly...

Caleb Carter

Caleb CarterBlack Clover Vol Light Frida Ramstedt: A Thrilling...

Prepare to be spellbound by...

Richard Simmons

Richard SimmonsFantastic Mr. Fox: A Literary Adventure That Captivates...

In the realm...

4.7 out of 5

| Language | : | English |

| File size | : | 28726 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 377 pages |